Arun Jaitley, Minister of Finance, released the twenty-first issue of India’s External Debt: A Status Report 2014-15. The report covers up to the end of March 2015.

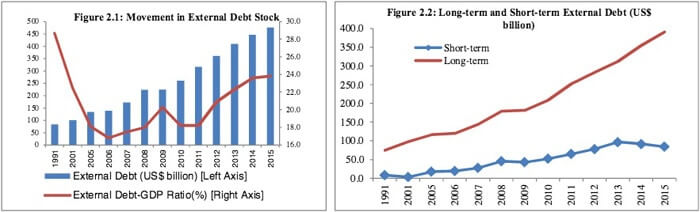

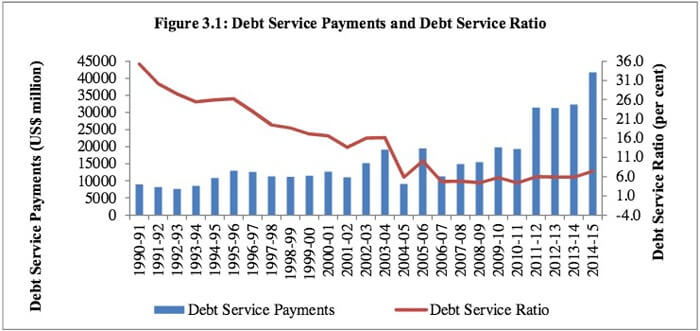

In US dollar terms, India’s external debt increased by almost $USD 30 billion in the past 12 months. Minister Jaitley said the country’s “crucial debt indicators,” which include the external debt to GDP ratio and the debt service ratio “remained in the comfort zone.”

Long-term borrowings dominate India’s external debt, and the numbers are rising. Long-term debt is rising faster than short-term debt.

In 2010, external commercial borrowings were 27 percent of the total external debt. Now they are 38 percent. Also in 2010, the ratio of external debt to GDP was 18 percent. Now it is 23.8 percent.

- India external debt charts shows debt rising.

Even so, the minister says India is one of the “less vulnerable” countries. The external debt indicators compare well with other indebted developing countries, especially when comparing external debt-GNI and debt service ratios.

Although the numbers are often looked at in US dollar terms, that doesn’t always tell the whole story. The value of the rupee has declined significantly over the past three years.

Bloomberg data shows that India is the third highest recipient of foreign fund inflows in 2014-2015, following behind Japan and South Korea in the Asia-Pacific region. No China data is available to compare.

One of the report summaries says:

At end-March 2015, India’s external debt (23.8 per cent of GDP) showed an increase of 6.6 per cent over the level at end-March 2014. The maturity structure of India’s external debt is favourable with long-term debt dominating it. Among the long-term components, commercial borrowings accounted for the largest share, followed by NRI deposits.

US dollar denominated debt continued to be the largest component of India’s external debt with a share of 58.3 per cent at end-March 2015. Government (Sovereign) external debt accounted for 18.9 per cent of total external debt at end-March 2015, while the rest 81.1 per cent was non-Government external debt.

On the debt servicing side, although the debt service payments are rising, mainly due to commercial borrowings, the debt service ratio is relatively flat, equivalent to what it was in 2004-5.

- India debt service charts show debt service ratio flat.

The PDF report is available on the government website.